is preschool tuition tax deductible 2019

You can make a tax-deductible donation to the Pet Association by sending your check to PO. If you are planning to run a small school as the only owner a sole proprietorship may be your best option.

501 C 3 Not For Profit Child Care Center Preschool

Tuition and Fees Financial Assistance Scholarships FACTS Advisory Board School Profile Testimonials Student Safety.

. Sole proprietorships are relatively inexpensive to start and maintain but you will be. Box 4342 Estes Park CO 80517. We depend on tax-deductible contributions to bring our innovative engaging high-quality education programs to families.

Donations can take up to 45 days to get to your chosen charity. We are proud to provide a learning environment that inspires intrinsic-motivation to learn. The cartoon nature of the material helps them remember how to behave in different situations they.

Please consider donating to Royalmont Academy to help us continue our mission of bringing Souls to Christ by forming Christian Leaders. Because you can help Royalmont lead the way in providing a faithfully Catholic education. East Point Academy Report Card 2019.

The staff of Incarnation Catholic School is serious about ensuring that your child is safe and secure at school. I was asked if one 501c3 non-profit can give money to another 501c3 charity. The comptroller shall keep a distinct account of actual receipts of non-tax revenues by each department board commission or institution to furnish the executive office for administration and finance and the house and senate committees on ways and means with quarterly statements comparing those receipts with projected receipts set forth in this section.

With the usual and necessary caveat of I am not attorney nor am I giving legal advice I responded that Yes when the transaction advances the donor non-profits charitable mission a non-profit can donate money and other resources to another non-profit. Your tax-deductible gift makes a difference. I am special education teacher in a school that has The Leader In Me program.

A dependent care FSA is a pre-tax benefit account used to pay for dependent care services such as preschool summer day camp before or after school programs and child or elder daycare. Start a sole proprietorship if you want to keep it simple. BAA scholarships are based upon the overall profile of a students commitment and aspirations gleaned from their application and interview.

If we cant reach you well send it to a similar charity and keep you updated. All donations are tax deductible and much appreciated. RD767 - Report on Corporate Income Tax Informational Reporting Requirement Pursuant to Item 3-523 of the 2021 Appropriation Act December 1 2021 RD780 - Tax Practitioners Online Portal T-POP Summary Report November 2021 RD108 - Virginia Transportation Planning For Sea Level Rise January 15 2022.

The USC Black Alumni Association BAA is a tax-deductible 501 c3 organization that provides partial tuition scholarships annually to USC undergraduate and graduate students. In 2019 The Daily Show received two Primetime Emmy nominations including Outstanding Variety Talk Series and Outstanding Interactive Program. The rules for.

Your donation is typically tax-deductible in the US. Contributions to HSAs are tax-deductible and the withdrawals are tax-free too so long as you use them for qualified medical expenses. Two types of tax credits the Lifetime Learning Credit and the American Opportunity Tax Credit provide tax benefits for qualified educational expenses for postsecondary education.

If you have self-only high-deductible health coverage you. The deduction for educator expenses appears on line 11 of the 2021 Schedule 1. Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language.

East Point Academy Report Card 20202021. For us to be successful we need your support and generosity. There are many possible business models for a preschool and the best one for you will depend on your resources.

Give to East Point. August 15 2019. The fact that it is repetitive and used in all classrooms is a benifit for my students who need consistent and easy to understand social questions.

Its rare but if we cant send your money to this charity well ask you to recommend another. A Dependent Care FSA is a smart simple way to save money while taking care of your loved ones so that you can continue to work. We would like to show you a description here but the site wont allow us.

We would like to show you a description here but the site wont allow us. East Point Academy is a tuition free public charter school in West Columbia SC. She formerly worked for Sarasota County Schools in Cyesis and.

This event raises funds to support the Tuition Assistance program. The Trump Organizations CFO pleads guilty to tax fraud Dulcé Sloan and Kerri Colby tackle the GOPs anti-drag queen obsession and Miss Universe 2021 Harnaaz Sandhu sits down with Trevor. The Internal Revenue Service IRS radically revamped the 1040 tax form in 2018 and revised it again for the 2019 2020 and 2021 tax years.

VH is a 501c3 Oregon. Will you consider a tax-deductible gift so that we may continue to provide a rich and rigorous education to the students we serve.

Tuition Kootenay Christian Academy

The 5 Best Tax Breaks For Parents Forbes Advisor

The Middle Class Crunch A Look At 4 Family Budgets The New York Times

Tuition Support Preschool Childcare Center Serving Mayfield Ky

Average Cost Of Child Care In Ct As Much As In State Tuition

Release Notes Cch Ifirm Cantax T1 2020 V 6 0 2021 30 31 01

Are Montessori Preschool Expenses Tax Deductible Hill Point Montessori

The Middle Class Crunch A Look At 4 Family Budgets The New York Times

Jodie Kehl Author At Manitoba Child Care Association

Release Notes Cch Ifirm Cantax T1 2020 V 6 0 2021 30 31 01

Can I Claim Private Pre K As A Tax Deduction

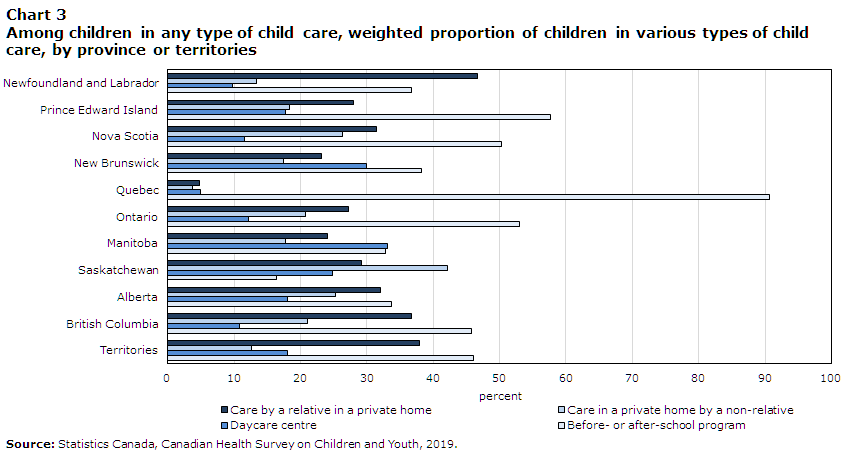

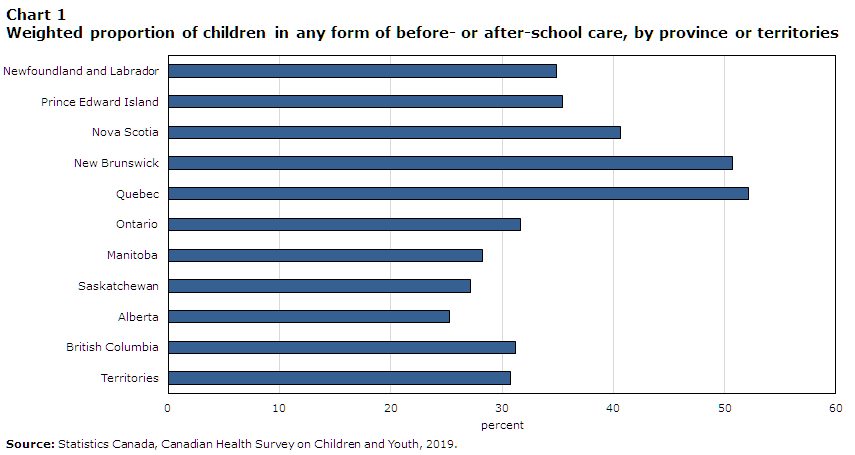

Use Of Child Care Before And After School In Canada

Tuition Support Preschool Childcare Serving Long Island Ny

Use Of Child Care Before And After School In Canada

Tuition Support Preschool Childcare Serving Long Island Ny

10 Canadian Tax Credits Deductions You May Not Know Refresh Financial